What exactly is Algorithmic Trade? The new Motley Fool

A good VPS might help remove downtime and ensure your own trade networks and you may algorithms focus on 24/7, even when your computer or laptop try turned off. So it configurations brings a reliable and you will legitimate ecosystem for the exchange things. Whenever building 1st trade actions, it’s required to ensure that they’re easy and first.

Market-To make Procedures

Among the beauties away from immediate 9.0 neupro algorithmic trading is you try not restricted to 1 form of trading. Can be done daytrading, swing trade, and you may long-term trading, all the at the same time, or perhaps purchase the one that you adore probably the most. Even if the buy execution is actually automated, there are couple reason why algorithmic trade remains mentally tiring. Leaving your procedures run on your property computer system can perhaps work, but never is really as a because the to shop for a remote servers to server their algorithmic change. When hosting the exchange in your family computer system there are boy things that you’ll restrict the transaction delivery.

What’s the better technique for algorithmic trading?

Away from impetus trading and you can arbitrage, to market and make and server learning-infused higher-volume trading, we know due to basic examples and you may actual-world programs from change formulas. I view the way we can also be apply automatic exchange options within the real-go out places. I and delve into exposure management in the algorithmic change, optimisation process, backtesting algorithmic change steps, and you will investigation purchase and a lot more. Algorithmic trade steps try some guidelines coded for the change app to help you immediately do trades rather than people intervention. Buyers make use of these ways to contain the better costs for stocks on the stock-exchange, exploit arbitrage possibilities, or capitalize on rates changes in the brand new financial market.

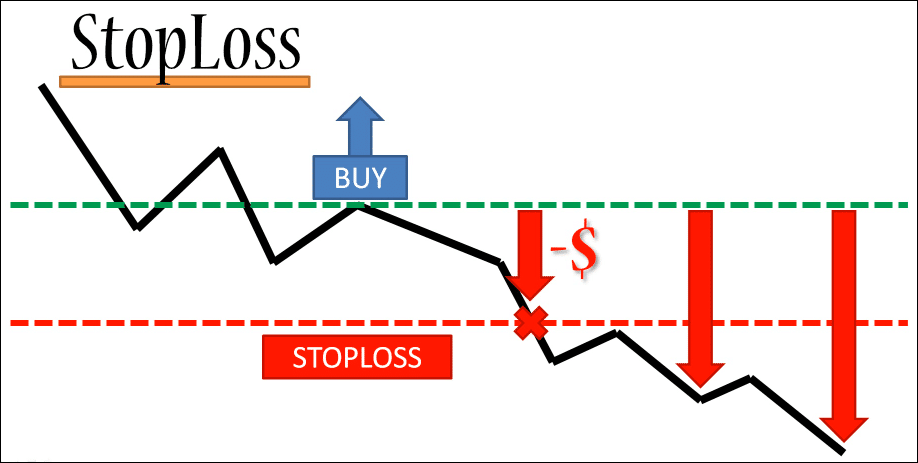

It’s necessary to utilize papers trade (simulation) ahead of using real money deals. Key risks are tech downfalls (equipment malfunctions, software insects), connectivity things, field impact difficulties (speed slippage, worst complete cost), and you may execution waits. Knowledge these risks is vital to possess using active chance government procedures.

While we’ve searched the realm of algorithmic trade actions, it’s clear that the sort of exchange provides a significant edge inside the now’s digital trade segments. Since the a trader, it’s very important to find the proper algo approach one to aligns with your change means and you will requirements. Implementing the new weighted average rate approach relates to looking at historical regularity profiles otherwise particular cycles to release quick pieces away from high regularity holdings. This permits traders to perform investments slowly and avoid disrupting the fresh industry. The brand new formula utilized in this tactic assures exact and you may error-totally free performance, which is challenging to get to inside manual trading. Algorithmic trading, also known as algo exchange, occurs when computers formulas — maybe not individuals — play investments according to pre-calculated regulations.

- Algorithmic trade steps has transformed financial places, improving results and you will and then make change more investigation-driven and you can systematic.

- Following the these procedures will help you change smoothly out of guide exchange to automated change, making sure you are better-happy to browse the field of algorithmic trading.

- The common obtain for each and every change is 0.7%, plus the annual come back (CAGR) are six.9%.

- Common algorithmic change tips were development-pursuing the, mean-reversion, and arbitrage.

- Whilst it’s tempting to ignore this action after you’ve discovered a successful means, it may help you save thousands of dollars if you decide to alive exchange an algo having undiagnosed insects.

Latency arbitrage, for example, exploits millisecond waits inside the research signal between transfers, enabling buyers to behave to your suggestions prior to it being totally shown in the costs. That it needs tall money inside system to minimize latency and ensure rapid delivery. Suggest reversion steps are based on the main one asset prices tend to come back to its historical mediocre after tall deviations. Buyers play with equipment such as Bollinger Rings, and this incorporate a relocation mediocre and contours place during the a given level of fundamental deviations a lot more than and you will less than they. Prices swinging exterior such rings may indicate overbought otherwise oversold standards, prompting investors can be expected a good reversion to your suggest. Exploring trick principles and examples of algorithmic exchange steps provides sense within their procedure.

It’s good for provide the pc usage of specific most strong purse, to the level in which its immediately conducted investments is control the brand new real-go out speed step to some degree. Actually rather than one to rates-moving virtue, the brand new millisecond impulse duration of an automatic individual are able to turn a good cash even from a comparatively quiet industry with little to no rates path. Financial organizations play with formulas inside components including mortgage cost, trading, asset-accountability management, and lots of automatic characteristics. Such as, algorithmic trading, labeled as algo change, is employed to have determining the brand new timing, rates, and you can amount of stock requests. Also called automated trade otherwise black colored-box trading, algo exchange spends computer software to shop for otherwise offer ties in the a rate difficult to possess individuals.

Rates Step Strategy

Such investments is actually started through algorithmic change possibilities to possess punctual delivery plus the greatest costs. A change system is vital to have carrying out algorithmic steps. Networks for example Option Segments’ MT4/5 give advanced features, real-time market research, and you may low latency, causing them to good for algo buyers. Trend-after the algorithms attempt to take advantage of the newest energy from stock costs by typing investments toward the present day business development.

A tool including Study Analyser speed everything you up-and features some thing concerned about what we you would like. Going for an established brokerage firm is vital, as you possibly can reduce the threat of possible complications with broker businesses heading boobs with your money, because the taken place having MF International. Such as, TradeStation EasyLanguage try a proprietary programming language produced by TradeStation Protection for the workstation program. Financial services and bank account are offered because of the Jiko Bank, a division of Middle-Central National Lender. Jiko AccountsJiko Bonds, Inc. (“JSI”), a registered representative-agent and you will member of FINRA & SIPC, will bring profile (“Jiko Account”) providing six-month All of us Treasury Bills (“T-bills”).